Trader Hub

Hyphens Pharma International Ltd – Year of Investment and Challenges

traderhub8

Publish date: Wed, 23 Aug 2023, 11:35 AM

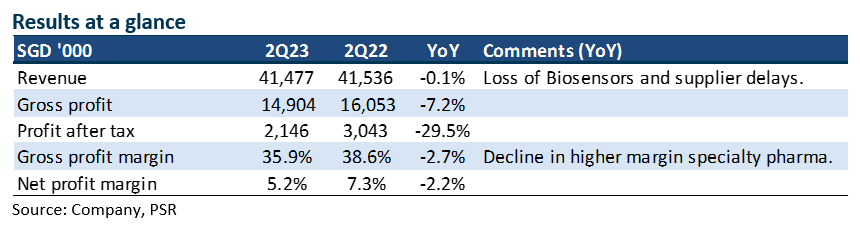

- 2Q23 PAT was down 29% YoY and below expectations. 1H23 revenue and PATMI were 46%/39% of our forecasts. The discontinuation in Biosensors distribution, absence of a major hospital tender and supply disruptions of several specialty pharma products was a drag on earnings.

- Hyphens announced a 3.6 cents special interim dividend for the 5th anniversary of its IPO.

- We maintain our FY23e revenue but lower our PATMI by 11% to S$8.0mn. Our operating expense forecast is raised as Hyphens will be investing more in senior hires and building up the DocMed platform. Our DCF target price is lowered to S$0.35 (prev. S$0.39). Our BUY recommendation is maintained.

The Positive

+ Healthy balance sheet and special dividend. The company announced a 3.6 cents special interim dividend for the 5th anniversary of its IPO. The payout of S$11mn is well supported by its net cash of S$33mn as of Jun23.

The Negative

– Weakness in specialty pharma. Specialty revenue was down 13% YoY in 1H23 to S$41mn. The drop was from the discontinuation of distributing Biosensors products (Dec22), the absence of one-off hospital tenders and supply disruptions of several specialty pharma products. Vietnam bore the brunt of the supply disruption with revenue contracting 27% in 1H23.

Source: Phillip Capital Research - 23 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments