CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

traderhub8

Publish date: Wed, 12 Jun 2024, 04:27 PM

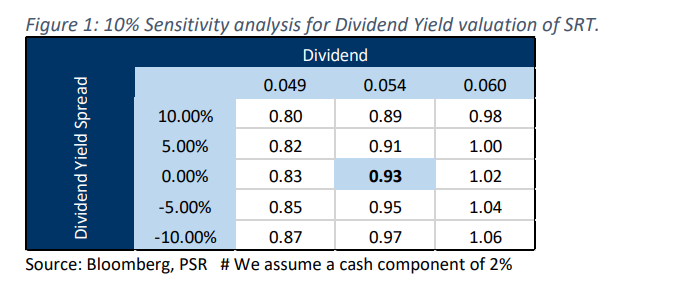

- We value CSOP iEdge S-REIT Leaders Index ETF (SRT) using a combination of historical dividend yield spread and price-to-book ratios. Using these two valuation methods, the target prices are S$0.93 and S$0.81, respectively. Applying equal weightage to both valuations, we initiate coverage with a BUY recommendation and target price of S$0.87.

- SRT gives exposure to 22 REITs across Singapore. It is one of the only two REIT ETFs listed on SGX that focuses solely on Singapore. This ETF offers investors stable income, attractive book value, and diversified, convenient, and efficient access to REITs across Singapore.

- We expect dividends from REITs to remain under pressure from higher interest rates. Due to interest rate hedges, effective interest rates will still creep up until 2025. In contrast, property valuations in Singapore have been stable, supported by transaction prices. Interest rate cuts can provide REITs the triple benefit of a yield that is more attractive to bonds, lower interest expenses, and increase valuations as cap rates compress.

ETF Background

The SRT is an investment product that provides investors with exposure to a diversified

portfolio of Real Estate Investment Trusts (REITs) listed across Singapore. It closely replicates

the performance of the iEdge S-REIT Leaders Index. SRT was established in 2021 and

comprises 22 securities with a market cap of S$69 mn as of 12 June 2024.

Investment Merits

• Investors gain the opportunity to participate in the potential income and capital

appreciation generated by the Singapore markets, offering convenient and efficient

access to this segment of the real estate sector.

• Sustainable income over the years (Figure 2). SRT dividends have been steadily increasing

since its IPO, currently maintaining around 5 to 6 cents.

• The book value of the ETF has become more attractive over the last two years (Figure 6).

It historically traded at a high of 1.2x price to book but now trades at a 5% discount to

book.

ETF Benchmark

SRT replicates as closely as possible the performance of the iEdge S-REIT Leaders Index, which

is designed to track the performance of REITS in Singapore. All eligible companies must meet

a minimum Average Daily Traded Value of US$500k, and existing constituents must meet a

minimum average daily traded value of US$400k.

Valuation

Dividend Yield Spread valuation

Dividend Yield measures the annual value of dividends received relative to the market price per

unit of the ETF. To value SRT, we will use the average dividend yield spread to a 10-year bond

(Figure 4). Since its inception, SRT has had an average 2.49% spread to a 10-year bond. The

current spread is 4.03%.

We value SRT at S$0.93 using a 2.49% dividend yield spread.

To determine the range of valuations, we applied a 5% and 10% discount and premium to both

Dividend Yield Spread and Forward Dividend (Figure 1). At the bottom end of our valuation

range, with a 10% higher projected dividend yield spread and a 10% lower forward dividend,

the ETF price is S$0.80 (Figure 1). At the top end of our valuation range, we use a 10% lower

projection of Dividend Yield Spread and a 10% higher Forward Dividend, and the ETF price is

S$1.06.

Source: Phillip Capital Research - 12 Jun 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 03, 2024