StarHub Limited – Pop in Dividends

traderhub8

Publish date: Wed, 14 Feb 2024, 11:56 AM

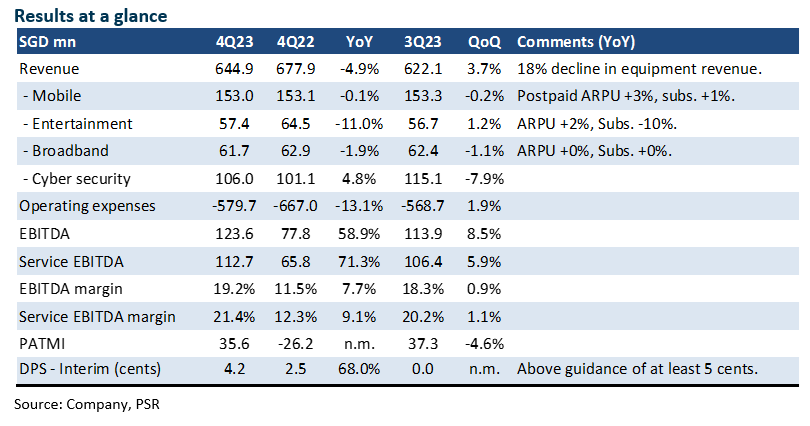

- 4Q23 results were within expectations. FY23 revenue and EBITDA were 99%/101% of our FY23 estimates. The full-year dividend was 6.7 cents, a 34% YoY rise and ahead of our 5 cents estimate.

- Revenue guidance for FY24e was for weaker growth of 1-3% (FY23: +5.5%). We believe mobile revenue faces stiffer competition from lower-end price plans, thus impeding ARPU growth despite contributions from higher-margin roaming revenue.

- The increase in FY24e dividend guidance from 5 cents to at least 6 cents has placed a minimum yield of at least 5% at the current price. Our target price is raised from S$1.21 to S$1.29 as we roll over our earnings to FY24e. We peg valuation to 6.5x FY24e EV/EBITDA, in line with other mobile peers. It will be another year of investment and slow growth for StarHub with its DARE+ initiative. The expected spend is S$80mn in FY24e, of which S$32mn is opex and S$48mn capex. Any premium valuations (or re-rating) for StarHub will depend on the efficiency and revenue gains from DARE+. This is elusive so far. Another catalyst will be monetisation or operating leverage at Ensign, the cybersecurity operations.

The Positives

+ Jump in dividends supported by FCF. The final dividend was 4.2 cents, up 68% YoY. Full-year dividend payout was 80%. It aligns with management guidance to distribute at least 80% of earnings or 5 cents, whichever is higher. The company mentioned it generated a free cash flow (FCF) of S$186mn, sufficient to cover the S$115mn in dividends. However, we believe lease payments of S$37mn should be deducted from FCF as it is operating in nature.

The Negative

– Slower services revenue. Service revenue declined 1.4% YoY in 4Q23 to S$527mn, the first decline in two years. Most segments were weak. Despite roaming revenue, mobile ARPU only rose 3% YoY to S$33. Entertainment revenue declined due to the absence of World Cup 4Q22. ARPU for broadband was flat YoY at S$34 as competition is accelerating ahead of the entry of Simba, the fourth mobile operator.

Source: Phillip Capital Research - 14 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024