StarHub Limited – Profit Guidance Raised 3 to 7%

traderhub8

Publish date: Mon, 07 Aug 2023, 11:21 AM

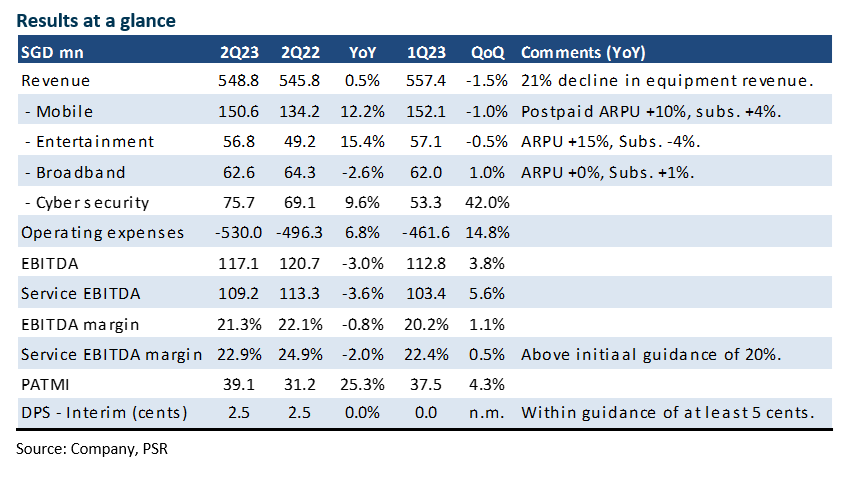

- 2Q23 revenue was below expectation but EBITDA exceeded. 1H23 revenue and EBITDA were 44%/58% of our FY23e estimates. Equipment sales was down 21% YoY in 2Q23, but margins were strong due to lower and delayed investments in the DARE+ transformation strategy.

- FY23e EBITDA guidance was raised by between 6 and 10%. We expect the planned S$310mn in Dare+ expenditure over the next 3 years to be cut by around S$25mn. Negotiations and rationalisation have helped lower expected spend.

- We lower FY23e revenue by 7% on account of weaker mobile equipment sales and project delays in cybersecurity. Conversely, EBITDA is raised by 6% from rationalisation and delay in Dare+ spending. We raise our recommendation from NEUTRAL to ACCUMULATE. Our target price is increased from S$1.08 to S$1.21, pegged at 6.5x FY23e EV/EBITDA, in line with other mobile peers.

The Positives

+ Strong growth in mobile revenue. 2Q23 mobile revenue rose 12% YoY to S$150mn from an increase in both ARPU and subscribers. The strength in ARPU is from higher roaming revenue, recontracting to higher priced plans and an increase in value added services (such as cyber protect plus).

+ Strength in entertainment revenue. Entertainment (or payTV) grew revenues on the back of higher ARPU from English Premier League (EPL). EPL has also helped in driving up advertising and commercial revenue.

The Negative

– Weakness and restructuring in enterprise revenue. Enterprise revenue (network, cybersecurity, regional ICT) was flat YoY in 2Q23. The bulk of the decline was from regional ICT business, lower hardware sales and discontinuation of legacy business in JOS Singapore.

Source: Phillip Capital Research - 7 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024