HRnetGroup Limited – Stability Creeping in

traderhub8

Publish date: Mon, 14 Aug 2023, 11:30 AM

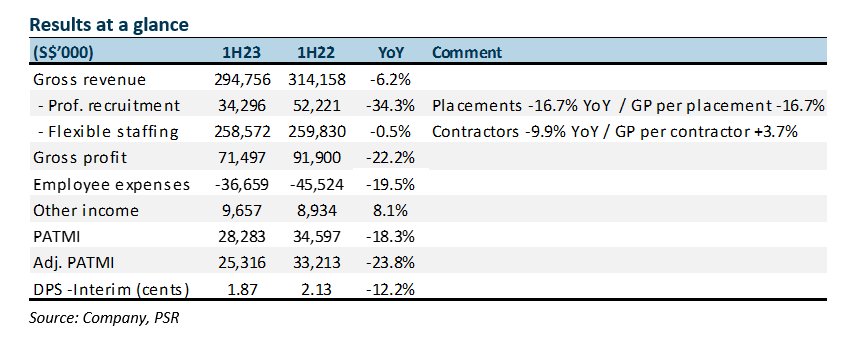

- The results were below expectations. 1H23 adjusted PATMI was 40% of our FY23e forecast. Weakness in earnings was largely due to professional recruitment contracting 34% YoY in revenue. North Asia experienced a major decline in technology hiring.

- Flexible staffing was resilient with revenue suffering a modest 0.5% YoY decline. The reduction in pandemic-related roles was replaced with luxury retail, consumer and logistics.

- We lowered our FY23e earnings by 11% to adj. PATMI of S$56mn. We cut our professional recruitment volume and price assumptions. Our BUY recommendation is maintained with a lower target price of S$0.88 (prev. S$0.98). The target price is 12x PE FY23e ex-cash. We believe hiring activities will trend sideways in 2H23 after the stellar growth in FY22, propped up by technology and pandemic-related placements.

The Positive

+ Flexible staffing (FS) resilient and flexible staff cost. Despite the absence of pandemic-related hiring, FS revenue was resilient. Sectors supporting FS in 1H23 were banking, luxury retail, consumer and logistics. FS is also expanding outside Singapore, namely Taipei, Hong Kong and Jakarta. In line with the weaker revenues, employee cost was down 19% YoY, from lower bonus payout and headcount reduction of 83.

The Negative

– Steep drop in North Asia and Singapore professional recruitment (PR). The drag on 1H23 earnings was the 37% and 31% YoY decline in North Asia and Singapore PR respectively. There was a severe drop in semiconductor and technology type placements. PR hiring will now be driven by industrial, engineering, lifescience and consumer sector roles.

Outlook

We expect FS to remain the near-term growth driver as corporates pivot towards contingent workers in an uncertain macro backdrop. Another FS growth pillar is expansion overseas, where its advantages are the track record, technology and capital. The strength of the ownership model was reflected by the flexibility to reduce employee expenses. From the $30mn share buyback plan announced in June 2022, there is a balance of S$16.6mn to be completed. In PR both business and candidate confidence is weak, negatively impacting demand and supply.

Maintain BUY and lower TP of S$0.88 (prev. S$0.98).

Our FY23e forecast is cut by 11% to adj. PATMI of S$56mn. The target price is a huge discount to global peers trading at 17x PE. HRnetGroup enjoys net cash of S$303mn with barriers of scale from its nearly 700 recruitment consultants across 16 cities.

Source: Phillip Capital Research - 14 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024