Trader Hub

City Developments Limited – Anticipating Stronger Growth in Hospitality

traderhub8

Publish date: Wed, 16 Aug 2023, 11:32 AM

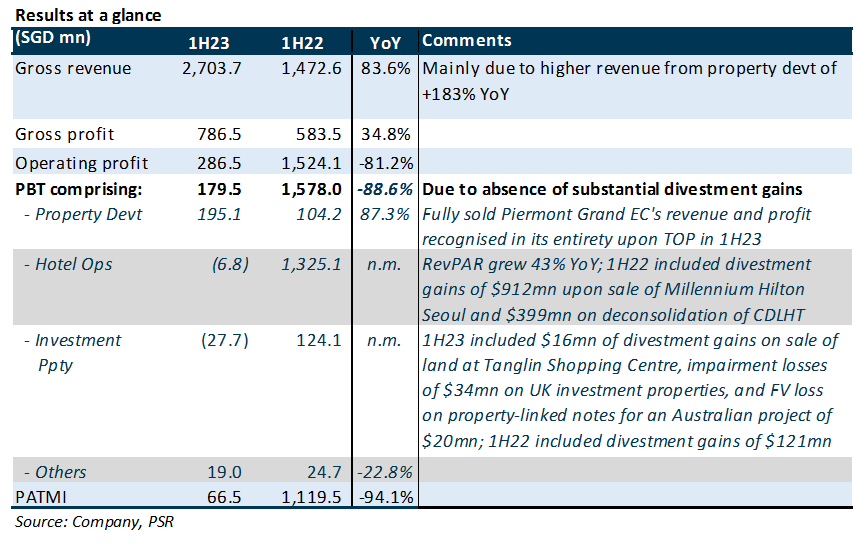

- 1H23 revenue of S$2.7bn (+83.6% YoY) was in line and formed 71% of our FY23e forecast due to the full revenue recognition of Piermont Grand Executive Condominium (EC) upon completion in 1H23. PATMI underperformed at S$66.4mn (-94.1% YoY) due to the absence of divestment gains in 1H22, as well as higher financing costs and impairment/ fair value losses in 1H23.

- Excluding divestment gains and impairment losses, EBITDA and PBT increased 48%; PATMI increased 1% YoY to S$104.3mn.

- Upgrade to BUY with a lower RNAV-derived TP of $8.22 from $8.33, a 45% discount to RNAV of S$14.94. We view CDL as a proxy for the Singapore residential market and hospitality recovery. Asset monetisation, unlocking value through AEIs and redevelopments, establishing a fund management franchise, and faster-than-expected recovery in the hospitality portfolio are potential catalysts for CDL, which could help narrow the discount between CDL’s share price and RNAV. CDL declared a special interim dividend of 4 Singapore cents per share.

The Positives

- Singapore residential market remains resilient despite cooling measures. In 1H23, the group and its joint venture associates sold 508 units with a total sales value of S$1.1bn (1H22: 712 units with a total sales value of S$1.6bn). Sales picked up in 2Q23 with the launch of the 638-unit Tembusu Grand in April with 58% of units sold to date. In July, the Group launched The Myst, a 408-unit development at Upper Bukit Timah and it is 32% sold to date at an ASP of S$2,057 psf. Looking ahead, the Group will be launching a 512-unit EC at Bukit Batok West Avenue 5 in 1Q24 and we anticipate strong demand for this project as it is near three MRT stations and the new Anglo-Chinese School (Primary), which is relocating to Tengah in 2030.

- Hospitality segment remains robust. Excluding divestment gains and impairment losses, EBITDA grew 69% due to stronger RevPAR performance across the portfolio (+42.7% YoY to S$151.5). It was driven by both an 18.3% increase in average room rates to S$216.8 and an 11.9% points (69.9% from 58%) increase in occupancy. Compared with pre-COVID 1H19, RevPAR grew 17.2%. We expect RevPAR to continue growing in 2H23, albeit at a slower pace. However, this segment reported a loss before tax of S$6.8mn, due to one-off expenses and higher interest expense. The group’s strategic expansion of its hotel portfolio continues as it recently completed the acquisition of the 408-room Nine Tree Premier Hotel Myeongdong II in Seoul in July 2023 for KRW140bn. Furthermore, the group has entered into a significant agreement to purchase the 416-room Sofitel Brisbane Central hotel in Australia for A$177.7mn, or about A$427,000 per key.

The Negatives

- Borrowing costs rose sharply to 4.1% for 1H23 compared with 2.4% for FY22. Consequently, net finance cost rose 3.8x YoY to S$147mn. Net gearing (including fair value on investment properties) also increased to 57% from 51% as at Dec22.

- Sizable impairment/ fair value losses on investment properties of $54mn. There were impairment losses of $34mn on UK investment properties due to a 30-50bps expansion in cap rates, leading to a drop in valuations. There was also a fair value loss on property-linked notes for an Australian project of $20mn.

Source: Phillip Capital Research - 16 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments