NetLink NBN Trust – Waiting for Tariff Review

traderhub8

Publish date: Wed, 23 Aug 2023, 11:35 AM

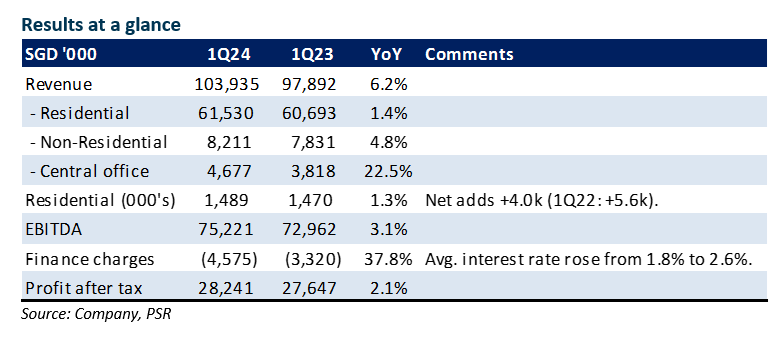

- Results were within expectations. 1Q24 revenue and EBITDA were 25%/25% of our FY24e forecasts. Core residential fibre revenue was up 1.4% YoY to S$61.5mn.

- 1Q24 EBITDA was up 3% YoY to S$75mn excluding the 38% surge in interest expense to S$4.3mn. Residential connections during the quarter was 4,023, below our trendline growth of 5,500 per quarter.

- No change to our FY24e forecast and DCF target price of S$0.87. Our NEUTRAL rating is unchanged. The new fibre rates NetLink can charge its customers is expected to be announced soon. Our base case is that fibre rates will see a modest decline. The distribution yield is sustainable from stable operating cash-flows from 1.48mn subscribers and access to financing.

The Positive

+ Opportunity in higher broadband bandwidth. As 10GBps broadband speeds become more available over the next few years, there will be more demand from telcos at Netlink central offices. Demand is for larger space, more cooling and increased power supply in the central office. The timeline to roll out more 10GBps will ultimately depend on customer end demand and use cases.

The Negatives

– Slower than expected residential connections. Residential connections increased by 4,023 in 1Q24, the slowest in four quarters. The weakness is caused by delays or time taken to renovate and move into the vacant units.

– Continued rise in interest expenses. Although the borrowings at a fixed rate is stable at 69.4%, the effective average interest rate in 1Q24 rose by 0.8% points YoY to 2.6%, driving interest expense up.

Source: Phillip Capital Research - 23 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024