Suntec REIT – the Discounted Gem

traderhub8

Publish date: Mon, 11 Sep 2023, 11:38 AM

- 1H23 revenue rose 10.2% YoY driven by strong rental reversion of Singapore assets (+17.5% yoy for Suntec City Mall, +10.8% yoy for office portfolio). Revenue for Suntec Convection surged 95.2% YoY and is expected to be back to pre-COVID level in FY24e.

- SUN is actively deleveraging with a target gearing ratio of 40% (1H23 gearing: 6%). c.S$14m divestment of strata units in Suntec Office were completed in the 1H23. SUN remains committed of the divestment and eyeing other assets such as 477 Collins Street.

- At 0.57x P/NAV (FY23e, NAV:2.13), SUN is currently trading at 0.33 SD below its mean of 0.78 P/NAV and below the average SREIT historical valuation of 0.86x P/NAV. We initiate coverage with a BUY recommendation on Suntec REIT and a DDM-based target price of S$1.47 and an annual dividend yield of 5.64% under the current share price.

Company Background

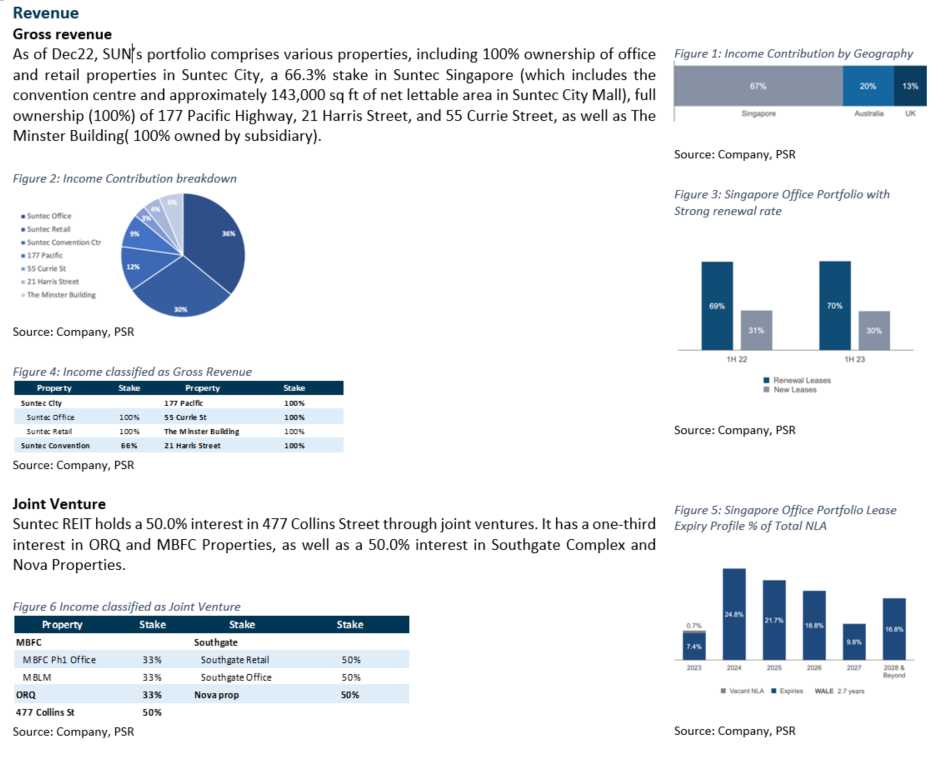

Suntec REIT (SUN) is a commercial real estate investment trust (REIT) with office and retail assets. It owns several Grade-A office buildings such as Suntec Office, a one-third stake in One Raffles Quay and a one-third stake in MBFC Towers 1 and 2. With 66.3% interest in Suntec Singapore Convention & Exhibition Centre and full ownership of Suntec City Mall, SUN owns an integrated commercial development known as Suntec City. ARA Trust Management (Suntec) Limited is the appointed manager. SUN has a diversified portfolio across geographies with 69% of revenue contributed from Singapore, 20% Australia and 13% UK.

Key Investment Merits

- Healthy operating metrics. In 1H23, the Singapore Offices achieved a rental reversion of 10.8% and an overall occupancy rate of 99.3%. Occupancy for Suntec City Mall remained stable at 98.3%, while rental reversion experienced a noticeable increase of +18.2% (a 1.7% QoQ growth). Tenant sales reached 108% of the pre-COVID level, with expectations of further enhancement upon the complete recovery of international tourism. Furthermore, revenue for Suntec Convention surged 95.2% YoY to 83.7% of the pre-pandemic level and the management is confident that the revenue will gradually recover back to pre-COVID level in FY24 (1H19: S$28.9m).

- Divestment over equity fundraising to lower its gearing. In 1H23, SUN successfully sold 3 strata units in Suntec Office, summing up to around 10k sqft with at least 20% above book value. Proceeds from the sales was c.S$14m. SUN is also eyeing potential divestment for mature assets such as 477 Collins Street in Melbourne (currently valued at S$433.3m). With the target of lowering the gearing to 40% (currently is at 42.6%, +20bp YoY), we believe SUN needs to divest c.S$200m worth of assets more.

- Valuation near record low. SUN is currently trading at 0.33 SD below the mean and 0.57x P/NAV (FY23e, NAV:2.13) which is below the average SREIT (0.86x P/NAV). Despite the hike in Singapore 10-year bond yield to 3.22%, SUN is still trading at a positive spread of 2.33% (FY23e). SUN can benefit the most from interest rate due to its lower fixed rate debt of 58% vs peers’ 76% (KREIT), 78.3% (MPACT) and 78% (CICT).

We initiate coverage with a BUY rating and a target price of S$1.47 based on DDM valuation, COE of 10.4% and terminal growth of 1%. We expect DPU of 6.83 cents for FY23e and 7.29 cents for FY24e, translating into yields of 5.64% and 6.03%, respectively. FY23e NPI yield is c.4.2%

Source: Phillip Capital Research - 11 Sep 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024