Keppel Corporation Ltd – Stable Energy Sales, Weak Real Estate Markets

traderhub8

Publish date: Mon, 23 Oct 2023, 11:40 AM

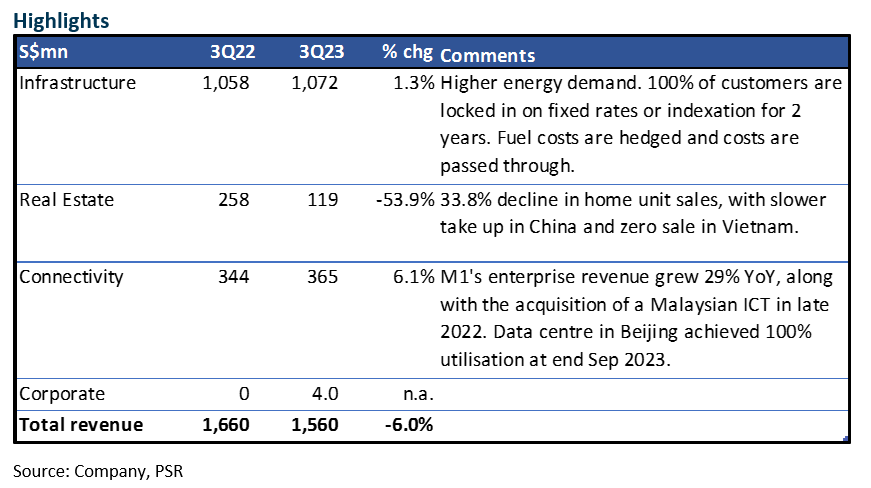

- 3Q23 revenue fell 6.0% YoY, dragged lower by weak property sales in China and India, after the rebound in 1H. 3Q23 net profit was higher YoY, but no financial detail was provided.

- The distribution-in-specie of 1 KREIT unit for every 5 Keppel shares has been approved by shareholders. This is equivalent to S$0.18 per Keppel share.

- Upgrade to BUY due to recent price correction. We maintain our earnings projections. After accounting for the KREIT distribution, our TP is revised lower to S$7.52 (prev. S$7.70).

The Positives

+ 3Q23 Infrastructure revenue grew 1.3% YoY, in spite of a volatile gas price and the implementation of temporary price control measures. 100% of its customers for integrated power sales are locked in on fixed rates, or indexed electricity price plans, for next 2 years. This provides stability to 68% of the group’s revenue. The fuel input costs are hedged, and costs are passed through, including the higher carbon taxes in 2024.

+ M1 expanded customer base by 7.2% YoY to 2,548. It grew enterprise revenue by 29.4% YoY, due to the acquisition of a Malaysian ICT in late 2022.

The Negatives

– Real estate 3Q revenue fell 53.9% YoY, as reflected in the weak property sentiment and rising interest rates. 3Q23 home unit sales fell to 260 units in China (1H23: 1,200 units) and 160 units in India (1H23: 870 units). No sales were recorded in Vietnam for this year.

– Net gearing rose to 0.89x from 0.86x at Jun 2023, after the distribution of interim dividend.

Source: Phillip Capital Research - 23 Oct 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024