Raffles Medical Group Ltd – Pressure Points Everywhere

traderhub8

Publish date: Wed, 08 Nov 2023, 11:46 AM

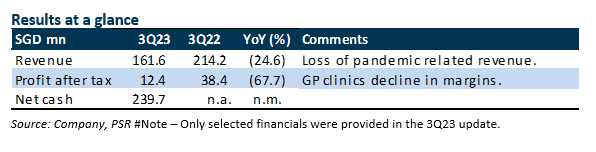

- 3Q23 revenue and PAT collapsed 25% and 67% YoY, respectively. Results were below expectations. 9M23 revenue and PATMI were 70%/51% of our FY23 estimates.

- We had expected weaker earnings as pandemic-related revenue ends. But some of the weakness was to be offset by higher prices, foreign patients and TCF. Foreign patients’ admissions were softer than expected due to rising costs in Singapore and price increases were moderate.

- We cut our FY23e revenue and profit by 6% and 34%, respectively. We downgrade our recommendation from BUY to NEUTRAL. Our DCF target price is cut to S$1.02 (prev. S$1.76). The next few quarters will be challenging. Earnings are likely to trend back to pre-pandemic levels due to the multiple headwinds including (i) Weaker foreign patient numbers as cost is escalating compared with neighbouring countries; (ii) Softer margins at the transitional care facilities (TCF) due to competition; (iii) Elevated start-up cost in the China hospital; (iv) Higher insurance claims as customer visits normalise.

The Positive

+ Healthy cash flow. The net cash continues to grow at S$239mn (2Q23: S$230mn). Cash continues to pile up after the completion of the hospitals in China. Capex has collapsed from a peak of S$96mn in FY19 to S$25mn last year.

The Negatives

– Revenue is down sharper than expected. We believe the drag in revenue came from lower pandemic-related vaccination and test service at the clinics and centres and softer foreign patient revenue. Revenue at the GP clinics is normalising back to pre-pandemic levels. Foreign patient volumes are below expectations due to the rising cost in Singapore.

– Margins collapsed. Margin weakness was from the loss of high-margin vaccination and testing services. Other expenses such as utilities and staff cost continue to climb. There were only moderate price increases during the period.

Source: Phillip Capital Research - 8 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024