Singapore Airlines – Declining Yields

traderhub8

Publish date: Thu, 09 Nov 2023, 11:36 AM

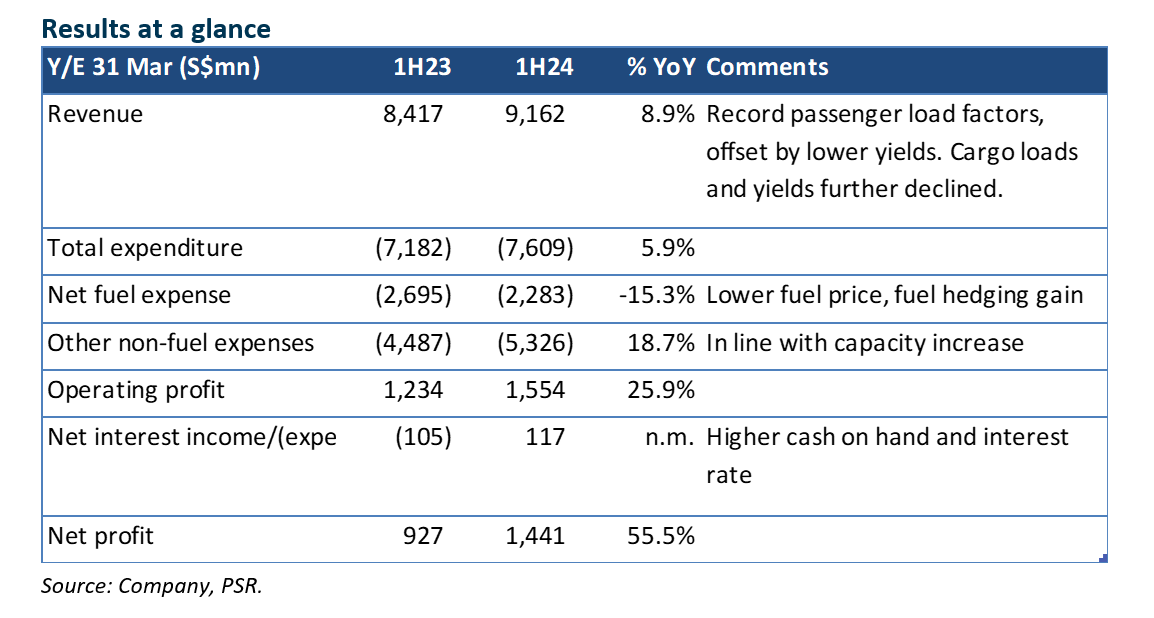

- 1H24 net earnings beat our estimates, at 82% of our FY24e forecast. It surprised us with an 18.8% YoY lower fuel bill despite the higher capacity and a S$244mn gain from fuel hedging. We raised our FY24e estimates by 14.3% to factor in the stronger 1H earnings.

- Growth was driven by strong passenger load (+38% YoY), while yields have begun to fall (-8.5%). Cargo remains weak as volume (-6.0%) and yields (-46.2%) were lower, though yields are above pre-Covid levels.

- SIA plans to redeem 50% of the remaining Mandatory Convertible Bonds (MCB) for S$1.71bn, bringing total redemption to S$5.1bn for FY24e.

- We maintain a REDUCE recommendation, and lower our TP to S$5.45 (prev. S$6.80), at 1x FY24e P/B (prev. 1.1x). This takes into account an ex-growth operating environment with yields and loads under pressure from increased competition and the fading off of travel demand.

The Positives

+ Higher passenger load offset decline in yields. Robust demand mainly from leisure travellers lifted passenger loads by 38.0% YoY. This helps to offset the decline in passenger yield such that revenue per available seat-km (RASK) only fell 2.0% YoY to 9.6 cents.

+ Lower average jet fuel price and fuel hedging gain. Average jet fuel price before hedging achieved was 29.2% lower YoY at US$105/barrel, and it booked a hedging gain of S$244mn (1H23: S$417mn). We had expected its jet fuel price to rise in 2Q in line with the market.

+ Higher net interest income. It booked net interest income of S$117mn from higher interest rate from net cash of S$5.2bn at end Mar 23.

The Negative

– Cargo remains a weak spot. In line with weaker trade flows globally and bigger capacity added from the return of passenger flights, cargo yield fell 46.2% to 41.8 cents/load tonne-km. This is however, still higher than pre-Covid of about 31 cents.

Outlook

Heightened competition from restoring capacity mainly from the North Asian airlines and a fading off of leisure travel will put pressure on yields. Jet fuel price is trending higher along with higher crude oil prices. We expect capex spending to rise in 2H to meet its target of S$2.3bn for FY24e (1H24: S$648mn). It would also incur cash outlay of S$5.1bn in FY24e for the redemption of MCBs and S$600mn for convertible loan. This would lower interest income in 2H.

Maintain REDUCE and lower TP to S$5.45, from S$6.80 previously, which is based on 1x FY24e book value (prev. 1.1x). We have raised our FY24e net profit estimates by 14.3% to factor in the strong 1H.

Source: Phillip Capital Research - 9 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024