Singapore Telecommunications Ltd – Aggressively Restructuring to Reality

traderhub8

Publish date: Mon, 13 Nov 2023, 11:29 AM

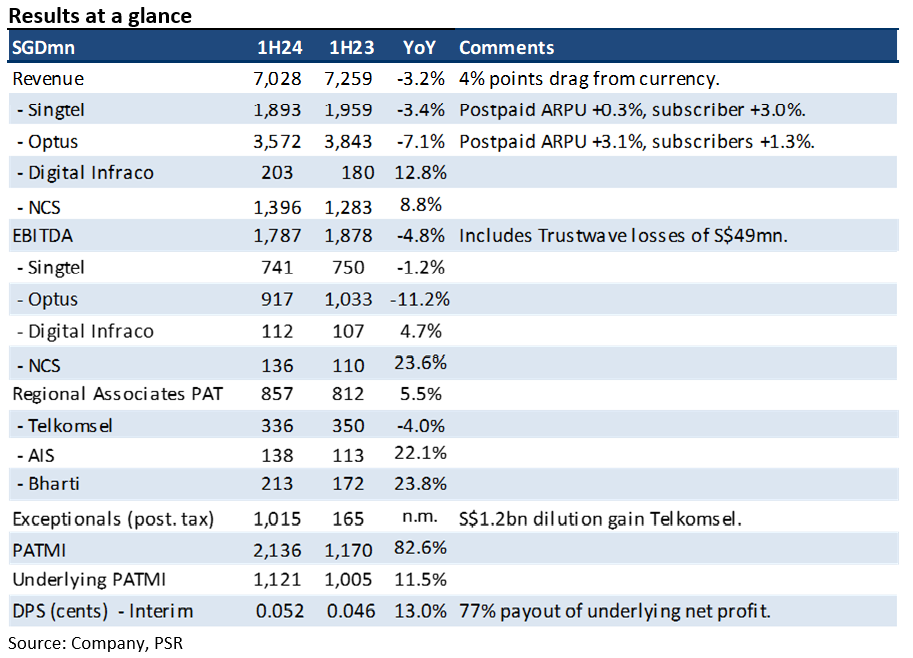

- 1H24 revenue and EBITDA were within our expectations at 46% of our FY24e forecast. EBITDA declined 5% YoY to S$1.78bn due to an 11% contraction in Optus earnings. Underlying net profit rose 11% to S$1.12bn despite a 4% point drag on currency.

- Singtel increased interim dividends by 13% to 5.2 cents and revised higher its payout ratio from 60-80% to 70-90%. A 3-year programme to remove S$600mn (of S$200mn p.a. FY24-26) of indirect cost was announced.

- We maintain BUY with an unchanged target price of S$2.80. Our earnings are largely unchanged before incorporating exceptional items. We believe Singtel is making significant strides in restructuring the entire group, monetising assets, and shedding unprofitable entities. Mobile competition in Australia is not abating and Optus needs to realign its cost structure to this reality. Underlying net profit in 1H24 fell 69% YoY to A$13mn.

The Positives

+ Increase in dividends and payout ratio. Singtel raised interim dividends by 13% to 5.2 cents. The company also increased its committed dividend payout ratio to 70-90% of underlying net profit (prev. 60-80%). Supporting dividends was FCF (plus associate dividends and lease payments) of S$817mn (1H23: S$1.29bn).

+ Strong margin expansion at NCS. NCS is beginning to contribute more significantly to group earnings. EBITDA expanded 24% YoY to S$136mn from revenue growth and cost optimisations. NCS booked S$1.4bn in orders in 1H24 (1H23: S$1.3bn). Much of the growth was outside the traditional government sector.

The Negative

– Still stubborn cost structure at Optus. Optus EBITDA declined 3% YoY to A$1.03bn despite revenues growing. There was an almost 50% jump in utility cost or an additional A$24mn. It was encouraging that staff costs have started to stabilise. 1H24 underlying net profit fell 69% ToT to A$13mn on lower operating earnings and higher finance costs. There was a staff restructuring cost of S$21mn under exceptionals, but which division was not disclosed.

Outlook

We believe management’s restructuring strategy is beginning to yield results:

- Of the planned $6bn of assets to be monetised in the near-term S$2bn has been unlocked*.

- Re-organising the group and resources into growth sectors has seen improvement in earnings at NCS and monetisation of the digital infrastructure division.

- Closure of Hooq (Mar20), divestment of Amobee (Jul22) and Trustwave (Oct23) has removed an estimated S$200mn of operating losses.

- The planned S$600mn cost out programme (or removal of S$200mn p.a. of indirect cost) from FY24 to FY26, will be a key initiative to lower fixed costs, especially at Optus.

Maintain BUY with unchanged TP of S$2.80

Our SOTP valuation is based on 6x EV/EBITDA (in line with peer valuation) for Singtel’s core Singapore and Australia businesses, at S$0.90/share. Associates are marked to market at S$1.90/share after a 20% discount to reflect volatility in their share prices.

Source: Phillip Capital Research - 13 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024