Singapore Banking Monthly – SORA Growth Flat, HIBOR Hits Record High

traderhub8

Publish date: Fri, 22 Dec 2023, 11:01 AM

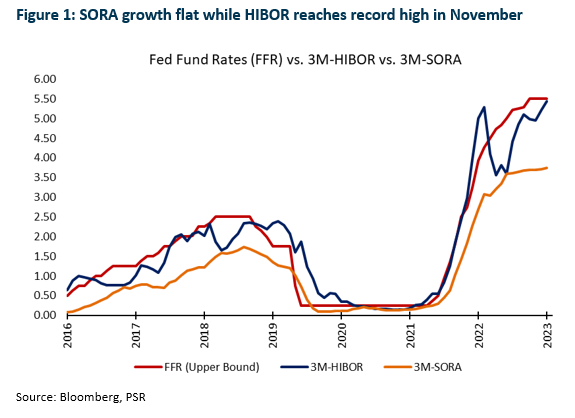

- November’s 3M-SORA was up 4bps MoM to 3.75% and was 6bps higher than the 3Q23 average of 3.69%. 3M-HIBOR was up 22bps MoM to reach a record high of 5.44%.

- Singapore domestic loans dipped 4.2% YoY in October, below our estimates. The loan decline was the smallest decline recorded in seven months. The CASA balance dipped slightly to 18.7% (Sep23: 18.9%).

- Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5.7% with upside surprise in dividends due to excess capital ratios and push towards higher ROEs. SGX is another major beneficiary of higher interest rates (SGX SP, BUY, TP S$11.71).

3M-SORA growth flat; 3M-HIBOR at record high in November

Singapore interest rates continued their gradual incline in November. The 3M-SORA was up 4bps MoM to 3.75%. November’s 3M-SORA surged by 107bps YoY and was 6bps higher than 3Q23 3M-SORA average of 3.69% (2Q23: 3.62%).

Hong Kong interest rates continued to rise and more than reversed the decline in 2023. The 3M-HIBOR was up 22bps MoM to 5.44%, and reached a record level, surpassing the previous record of 5.29% in December 2022. November’s 3M-HIBOR improved by 44bps YoY and was 43bps higher than 3Q23 3M-HIBOR average of 5.01% (Figure 1).

Singapore loans growth decline flattens

Overall loans to Singapore residents – which captured lending in all currencies to residents in Singapore – fell by 4.19% YoY in October to S$792bn. This was below our estimate of low-single digit growth for 2023 as the rise in interest rates started to be fully felt by consumers. Nonetheless, this is the smallest decline recorded in seven months.

Business loans fell by 6.06% YoY in October. Loans to the building and construction segment, the single largest business segment, fell 0.07% YoY to S$168bn, while loans to the manufacturing segment fell 20.16% YoY in October to S$21.5bn.

Consumer loans were down 1.14% YoY in October to S$311bn, as dips in other segments were offset slightly by strong loan demand in the housing segment. Housing loans, which make up ~70% of consumer lending, grew 1.14% YoY in October to S$224bn for the month.

Total deposits and balances – which captured deposits in all currencies to non-bank customers – grew by 3.08% YoY in October to S$1,797bn. The Current Account and Savings Account, or CASA proportion, dipped slightly to 18.7% (Sep23: 18.9%) of total deposits, or S$336bn.

Hong Kong loans growth continues to decline

Hong Kong’s domestic loans growth declined 4.19% YoY and declined 0.50% MoM in October. The YoY decline in loans growth for October was lower than the decline of 4.89% in September 2023, and the MoM decline was lower than the decline of 0.91% in August 2023.

Source: Phillip Capital Research - 22 Dec 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024