Keppel Ltd – Energy Buttressed Bottom Line

traderhub8

Publish date: Mon, 05 Feb 2024, 09:59 AM

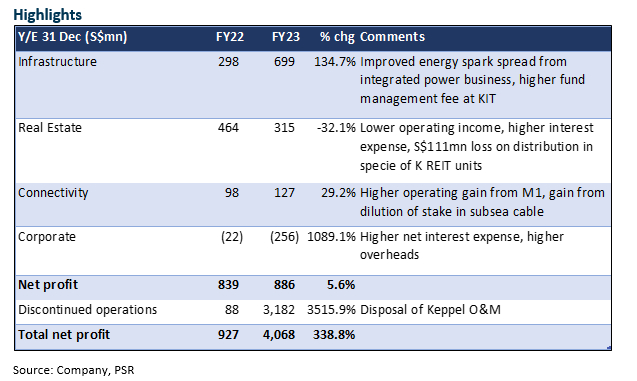

- FY23 core net profit grew 5.6% YoY, in line with our expectations. Recurring income grew 54% to S$773mn, or 88% of net profit. Infrastructure made up 90% of this.

- Growth was underpinned by a higher margin from energy sales, offset by the doubling of interest expense to S$328mn, and S$111mn loss on distribution of K Reit units to Keppel shareholders.

- Energy earnings are sustainable, with 60% of capacity locked in on long-term contracts for more than 3 years. A lower interest rate environment could rejuvenate M&A and fundraising, lifting funds under management. The sale of the rigs in AssetCo could return S$3.1bn to the group, we estimate.

- Downgrade to ACCUMULATE from BUY on recent share price gains. We raised FY24e net profit projections by 0.4%. Our SOTP-derived TP is revised higher to S$7.98 (prev S$7.52), as recurring income takes a bigger share of net profit.

The Positives

+ Integrated power business doubled operating income and margins, benefitted from improved energy spark spread and exit from low-margined legacy contracts. 90% of its capacity is contracted for >1 year, providing visible and sustainable earnings. KIT contributed higher fees after a change in fee structure.

+ M1 grew revenue by 6%, after the acquisition of a Malaysian ICT in late 2022. Key drivers were higher enterprise customer sales (+27%) and total customers (+2%), and recovery of roaming services to 80% of pre-COVID.

The Negatives

– Real estate division was impacted by higher interest expense, lower fair value gains on investment properties and higher overheads at asset management units. The distribution of K Reit units to Keppel shareholders led to a S$111mn loss as the book value exceeded the market value.

– Recurring fee income from fund management fell 5.5% to S$86mn. About S$5bn new funds was raised in FY23. Investors’ appetite was muted amidst rising interest rates and tighter credit conditions. But the pace could pick up in FY24, as recently-acquired Aermont Capital extends its investor reach, and the interest rate environment turns favourable.

– Net gearing rose to 0.9x. Management has an internal net gearing threshold of 1x. Free cash flow was negative S$228mn. Net debt as at end Dec was S$9.7bn, at an average interest cost of 3.75%. Interest expense doubled to S$328mn.

Source: Phillip Capital Research - 5 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024