DBS Group Holdings Ltd – Fee Income Recovers; Strong Dividend Growth

traderhub8

Publish date: Fri, 09 Feb 2024, 10:42 AM

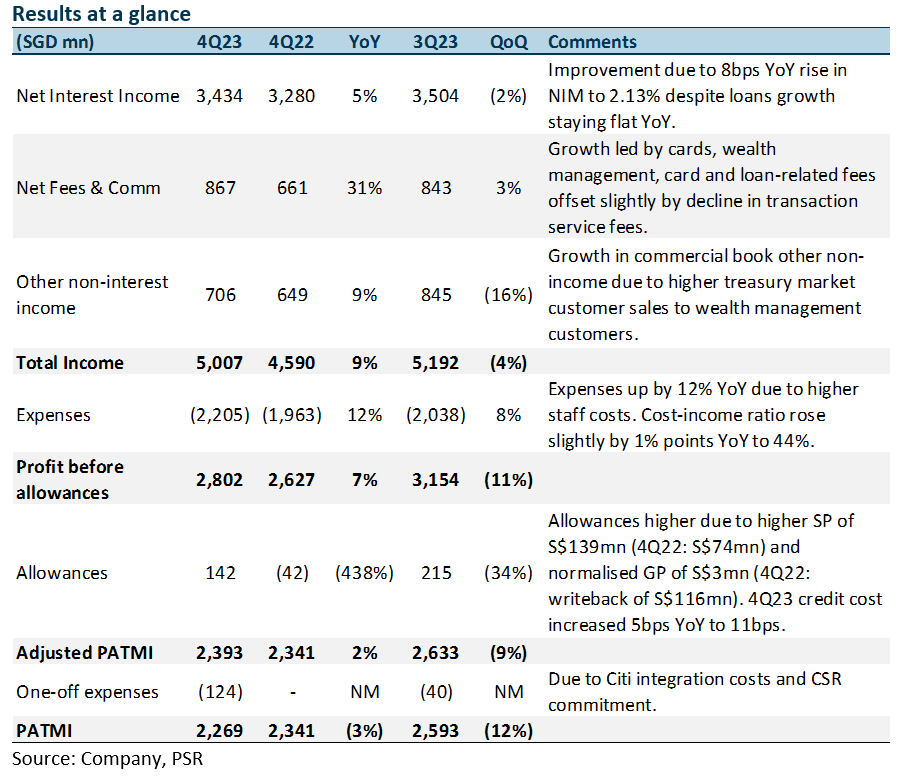

- 4Q23 adjusted PATMI of S$2.39bn was slightly above our estimates due to higher NII, fee income, and other non-interest income offset by higher allowances. FY23 adjusted PATMI is 102% of our FY23e forecast. 4Q23 DPS is raised 29% YoY to 54 cents with an additional 1-for-10 bonus issue, dividend payout ratio was higher at 48.5% in FY23 (FY22: 47.7% excluding special dividends).

- NII rose 5% YoY on NIM expansion of 8bps despite loan growth remaining flat. Fee income rose 31% YoY, while other non-interest income grew 9% YoY. DBS has maintained its FY24e guidance of double-digit fee income growth (from wealth management and credit card fees), stable NII as higher NIMs from higher-for-longer rates will be offset by lower loan growth and total allowances to normalise to 17-20bps of loans. FY24e PATMI to be maintained at around the current levels in FY23.

- Maintain BUY with a lower target price of S$38.90 (prev. S$41.60). We lower FY24e earnings by 1% as we lower NII estimates for FY24e due to lower NIMs, and increase allowances and OPEX estimates, offset by higher fees, and other non-interest income. We assume 2.14x FY24e P/BV and ROE estimate of 16.0% in our GGM valuation. Stable NII from a recovery in loan growth and double-digit growth in fee income will sustain earnings momentum.

The Positives

+ NIM and NII continue to increase YoY. NII rose 5% YoY to S$3.4bn due to an 8bps NIM increase to 2.13% (3Q23: 2.19%) as interest rates continue to remain high, despite loan growth remaining flat YoY. Loan growth was stable as higher trade and consumer loans were offset by lower non-trade corporate loans. Nonetheless, the Citi Taiwan consolidation contributed S$10bn to loans.

+ Fee income recovers strongly. Fee income rose 31% YoY to S$867mn. WM fees increased 41% YoY driven by strong net new money inflows as customers shifted deposits into bancassurance and investments, while card fees grew 27% YoY from higher spending and the integration of Citi Taiwan. Loan-related fees rose 80% YoY, while investment banking fees were up 26% YoY. These increases were moderated by a 4% YoY decline in transaction fees as trade finance slowed.

+ Other non-interest income rose 9% YoY. Other non-interest income growth was mainly due to higher treasury customer sales and gains from investment securities. Notably, commercial book accounts for a majority of other non-interest income was at 55%, while treasury markets accounts for 45%.

The Negatives

– Allowances rose 438% YoY. 4Q23 total allowances were higher 438% YoY due to normalised GP of S$3mn (4Q22: writeback of S$116mn) and higher SP of S$139mn (4Q22: S$74mn). As a result, 4Q23 credit costs rose to 11bps, with FY23 credit costs at 11bps. The NPL ratio was flat at 1.1% (4Q22: 1.1%), while GP reserves grew 4% YoY to S$3.90bn. Notably, management mentioned S$2.2bn of management overlay, which could be released if SP comes in higher than expected.

– CASA ratio decline continues. The Current Account Savings Accounts (CASA) ratio fell 8% points YoY to 52.3%, mainly due to the high-interest rate environment and a continued move towards fixed deposits (FDs). Nonetheless, total customer deposits grew 2% YoY to S$535bn as the decline in CASA deposits was offset by growth in FDs and a contribution of S$12bn from the Citi Taiwan consolidation.

Source: Phillip Capital Research - 9 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024