Singapore Telecommunications Ltd – Bruised by Currency

traderhub8

Publish date: Mon, 26 Feb 2024, 11:13 AM

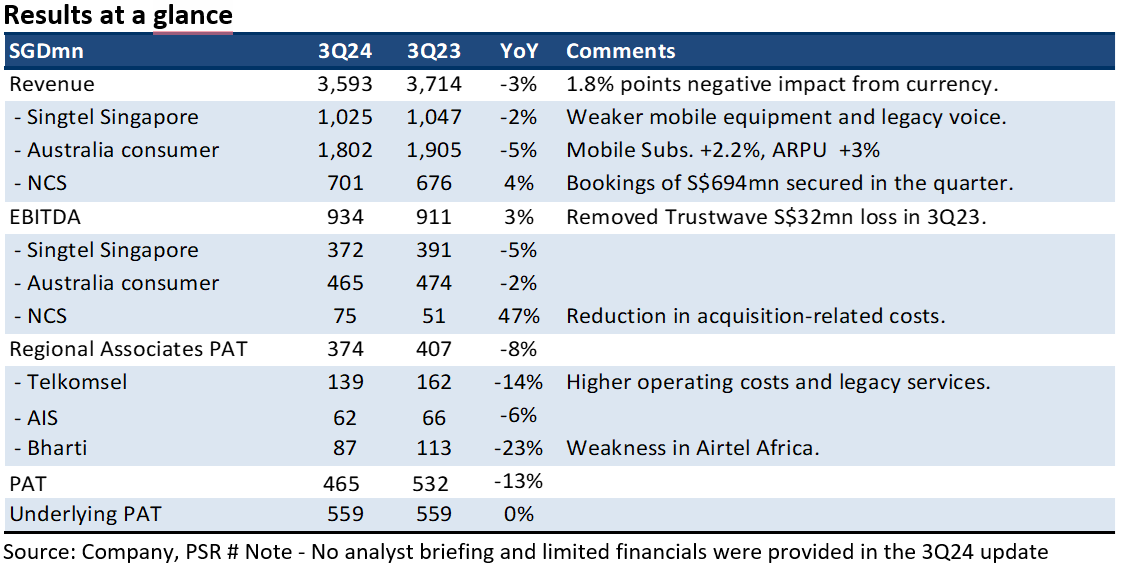

- 3Q24 earnings were within expectation. 9M24 revenue and EBITDA were 73%/75% of our FY24e forecast. Currency was almost a 2% point drag to earnings.

- 3Q24 associate contribution disappointed with an 8% YoY decline to S$374mn. Airtel Africa suffered a YTD24 translation of S$130mn following a massive depreciation of the Nigerian Naira during the quarter. Direct stake in Airtel Africa has been divested.

- We maintain BUY with an unchanged target price of S$2.80. We lowered our associate earnings by 10% due to the weakness in Airtel Africa. But this was offset by a lower finance expense assumption. Our FY24e PATMI is reduced by 3%. We expect an upside surprise in EBITDA margins in 4Q24 if Singtel can deliver its S$200mn of cost out by the end of FY24. Mobile price repair is underway in multiple countries where Singtel operates. We expect this to drive earnings together with plans to monetise S$4bn of assets further.

The Positive

+ Early mobile price repair in Australia. Optus postpaid ARPU of A$42 is the highest in more than four years. We believe price repair is underway. Competition, especially for entry-level price plans, has eased, and prices are edging higher. Despite the network outage, mobile service revenue grew 3.4% YoY.

The Negative

– Airtel Africa currency hit. Contribution from Bharti Telecom declined 23% YoY to S$87mn. Operations in India grew 14% YoY supported by an 8% rise in ARPU to Rp208. Currency took a toll on the results, with a 4% decline in the rupee against the Singapore dollar. A translation loss hit Africa operations due to the weakness in the Nigerian Naira.

Outlook

We expect mobile price recovery in Australia, India, Thailand, and Indonesia to drive earnings growth. An upside surprise in margins will stem from Singtel’s planned S$600mn reduction in core cost, largely in Optus.

Maintain BUY with unchanged TP of S$2.80

Our SOTP valuation is based on 6x EV/EBITDA (in line with peer valuation) for Singtel’s core Singapore and Australia businesses, and associates are marked to market after a 20% discount to reflect volatility in their share prices.

Source: Phillip Capital Research - 26 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024