Trader Hub

Singapore Telecommunications Ltd – Accounting Spring Cleaning, Sprinkled With Cash

traderhub8

Publish date: Thu, 02 May 2024, 10:42 AM

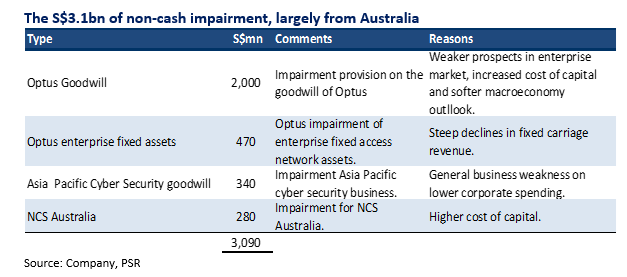

- Singtel announced exceptional non-cash impairment provisions of around S$3.1 bn in 2HFY24. As a result, Singtel will report a net loss in 2H24. Reasons for the impairment include higher interest rates, the rollout of NBN, weaker enterprise spending, and softer macro conditions.

- Singtel also announced that Optus has signed an 11-year agreement to provide TPG Telecom with access to Optus mobile network sites in regional Australia. Optus will receive a service fee worth A$1.6bn over the 11 years. There is an A$900mn fixed fee and A$690mn variable as the Optus 5G network rolls out.

- We view the write-offs as one-offs without impacting our valuations. Singtel also made a S$1bn goodwill impairment on Optus in FY23. Sharing networks with TPG would be positive in terms of conserving cash flows and reducing excess capacity if TPG were to roll out its network. We maintain BUY with an unchanged target price of S$2.80. We expect Singtel’s operational performance to improve as mobile price repair occurs in multiple countries. Other share price catalysts include plans to monetise S$4bn of assets further, S$600mn of operating expense savings, and GPU-as-a-Service with Nvidia.

The exceptional provisions will not impact Singtel’s dividend policy (70% and 90% of underlying net profit). Singtel is on track to pay at the upper end of its dividend policy for FY24 (PSR: 84% payout ratio).

Network sharing agreement between Optus and TPG Telecom

- What will Optus provide? Optus will provide TPG Telecom access to its 2,444 regional radio access network sites in regional Australia, of which only 200 are 5G enabled. Optus will accelerate its 5G sites in regional Australia to 1,500 by 2028 and 2,444 by end-2030. There is an option for TPG Telecom to extend the agreement for a further five years. Optus will receive total service fees of around A$1.6bn over the 11-year agreement (net of the spectrum fees A$1.17bn).

- What will TPG provide? TPG will license some of its spectrum to Optus. Optus will pay A$420mn over the entire 11-year term for the use of the spectrum, which allows Optus to improve the capacity of its network without requiring more network sites.

Source: Phillip Capital Research - 2 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

CSOP IEdge S-REIT Leaders Index ETF – The Deeper Discounted Singapore REIT ETF

Created by traderhub8 | Jun 12, 2024

Valuetronics Holdings Ltd- Get Paid as Customer Base Is Refreshed

Created by traderhub8 | Jun 03, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments