Singapore Banking Monthly – Fee Income the Driver

traderhub8

Publish date: Fri, 17 May 2024, 09:45 AM

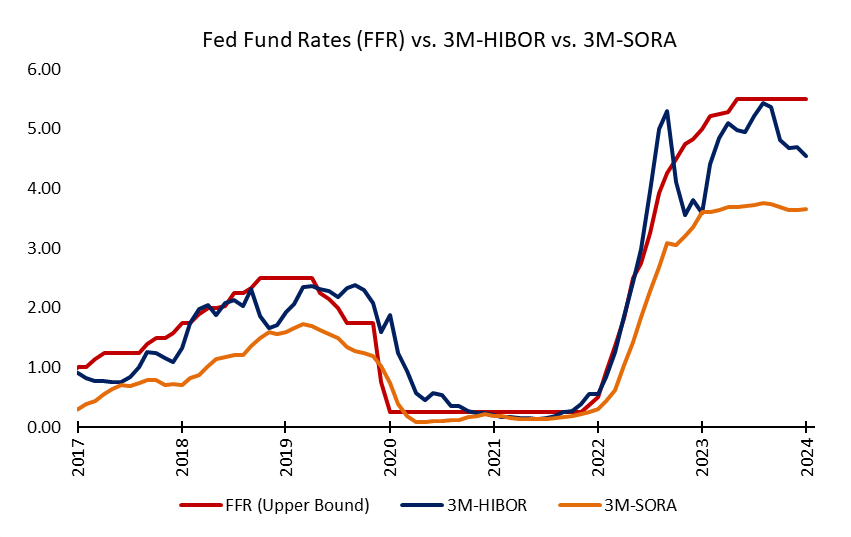

- April’s 3M-SORA was up 1bp MoM to 3.65% and 1bp lower than the 1Q24 average. Nonetheless, the 3M-SORA rose by 5bps YoY. 3M-HIBOR was down 16bps MoM to 4.54%, reversing the increase of 2bps in March.

- 1Q24 bank earnings were slightly above expectations. PATMI rose 8% YoY, supported by fee income growth of 11% YoY, while NII growth moderated to 3%. FY24e guidance is for NII to remain stable YoY with NIMs at the current levels of around 2-2.25% and loan growth of low-single digit. Fee income is expected to sustain earnings with the expectation of double-digit growth in FY24e.

- Singapore domestic loans rose 1.4% YoY in March, the first increase in 16 months. We expect low-single-digit growth for 2024 as loan growth is expected to continue to be positive going into 2H24. The CASA balance rose slightly to 18.3% (Feb24: 18.2%).

- Maintain OVERWEIGHT. The banks had a positive April performance on the back of strong results. The best performer continued to be DBS, with a 7% increase, while OCBC and UOB improved by 5% and 3%, respectively. We remain positive on banks. NIMs may stay flat despite the higher-for-longer interest rate environment, but a recovery in loan growth and fee income will uplift profits. Bank dividend yields are also attractive, with upside surprises due to excess capital ratios and a push towards higher ROEs.

3M-SORA stable while 3M-HIBOR declined in April

Singapore interest rates were up 1bp to 3.65% in April, having maintained these levels for the past three months. Nonetheless, April’s 3M-SORA rose by 5bps YoY but was 1bp lower than the 1Q24 3M-SORA average of 3.66% (4Q23: 3.74%). Notably, this is the smallest YoY increase since March 2022.

Hong Kong interest rates dipped in April. The 3M-HIBOR was down 16bps MoM to 4.54%, reversing the increase of 2bps in March. Nonetheless, April’s 3M-HIBOR improved by 95bps YoY but was 19bps lower than 1Q24 3M-HIBOR average of 4.73% (Figure 1).

Figure 1: SORA stable while HIBOR declined in April

1Q24 RESULTS HIGHLIGHTS

- NII grows slightly despite NIM stagnating

DBS’ 1Q24 adjusted earnings of S$2.96bn was slightly above our estimates due to higher NII, fee income, and other non-interest income offset by higher expenses. 1Q24 adjusted PATMI is 28% of our FY24e forecast. NII rose 7% YoY to S$3.5bn due to a 2bps NIM increase to 2.14% (4Q23: 2.13%) as interest rates continue to remain high and loan growth grew modestly by 2% YoY. DBS has increased the FY24e guidance it provided in the previous quarter, with net interest income to be “modestly better” than FY23, with NIMs to sustain an FY23 exit NIM level of 2.13%. Low-single-digit loan growth guidance for FY24e is maintained. As a result, DBS is guiding for PATMI to be above FY23 levels.

OCBC’s 1Q24 earnings of S$1.98bn were slightly above our estimates from higher non-interest income from growth in fee, insurance, and trading income and moderate growth in NII offset by higher allowances and expenses. 1Q24 PATMI was 28% of our FY24e forecast. NII growth of 4% YoY was led by a 5% increase in average assets and loans growth of 2%, which was offset slightly by NIM moderating by 3bps YoY to 2.27%. NIM moderation was mainly from higher funding costs, which offset the increase in asset yields. OCBC has provided FY24e guidance for NIM to be at the higher end of 2.20% to 2.25%, with 1Q24 exit NIM currently at 2.27% and loan growth of low-single-digit for FY24e.

UOB’s 1Q24 adjusted earnings of S$1.57bn met our estimates as higher fee income and other non-interest income were offset by lower-than-expected NII and higher expenses. 1Q24 adjusted PATMI was 25% of our FY24e forecast. NII dipped 2% YoY from NIM falling 12bps YoY to 2.02% mainly due to loan margin compression due to competition for high-quality credits and high cost of funding as the impact from the recent deposit repricing has yet to be felt. UOB has guided loan growth to a low single-digit and NIM to hold above 2% for FY24e. UOB expects to see demand for loans pick back up with rate cuts expected in 2H24, and we expect a slowdown in the first few quarters of FY24 as rates remain high, with the recovery expected in 2H24.

- Fee income provided earnings boost

DBS’ 1Q24 fee income rose 23% YoY to a record level of S$1,043mn. The growth was led by wealth management (WM) fees surging 47% YoY from stronger market sentiment and an increase in assets under management (AUM). Card fees rose 33% YoY from higher spending, while loan-related fees grew 30% YoY. DBS has maintained its guidance of double-digit fee income growth for FY24e, which WM and credit card fees will sustain. The growth was mainly from a shift in investor sentiment due to the expectation of rate cuts, where demand and funds were moved from deposits into investment products.

OCBC’s 1Q24 fee income rose 6% YoY mainly due to growth in wealth management fees (+20% YoY) offset slightly by lower loan and trade-related fees (-6% YoY), lower brokerage and fund management fees (-5% YoY) and stable investment banking fees. Furthermore, the Group’s 1Q24 wealth management income grew 19% YoY and contributed 36% to the Group’s total income (1Q23: 32%). OCBC’s recent acquisitions of PT Bank Commonwealth in Indonesia will accelerate its growth in ASEAN. Therefore, we are expecting fee income growth of 12% for FY24e.

UOB’s 1Q24 fees grew 5% YoY, largely due to higher loan-related fees of S$244mn (+3% YoY) and a pickup in wealth management fees to S$164mn (+6% YoY) due to a return in investor confidence. Notably, wealth management assets under management (AUM) grew 11% YoY to S$179bn. Credit card fees continued to grow, reaching S$90bn in 1Q24 (+11% YoY) but normalized from last quarter’s seasonal high (-28% QoQ). As such, they have guided for double-digit fee income growth in FY24e, which could add ~S$220mn to revenue.

Source: Phillip Capital Research - 17 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024